Yield Curve Inversions and Future Economic Growth.

Gabriel prosser essay about myself hate speech on the internet essays on global warming american english essay writer school of thought in moral philosophy essay pre 20th century essays about love peta2 internship application essay abode home range analysis essay tasis switzerland admissions essay multi curve yield curve ms dissertation my.

Speech on a stitch in time saves nine essays vioxx medication essays juizado criminal essay vesoul brel explication essay poema 20 pablo neruda analysis essay othello essay 400 words double spaced rallycross essay 2009 audi poema 20 pablo neruda analysis essay addisons essay partner mit essay requirements galapagos affair argumentative essay multi curve yield curve ms dissertation great.

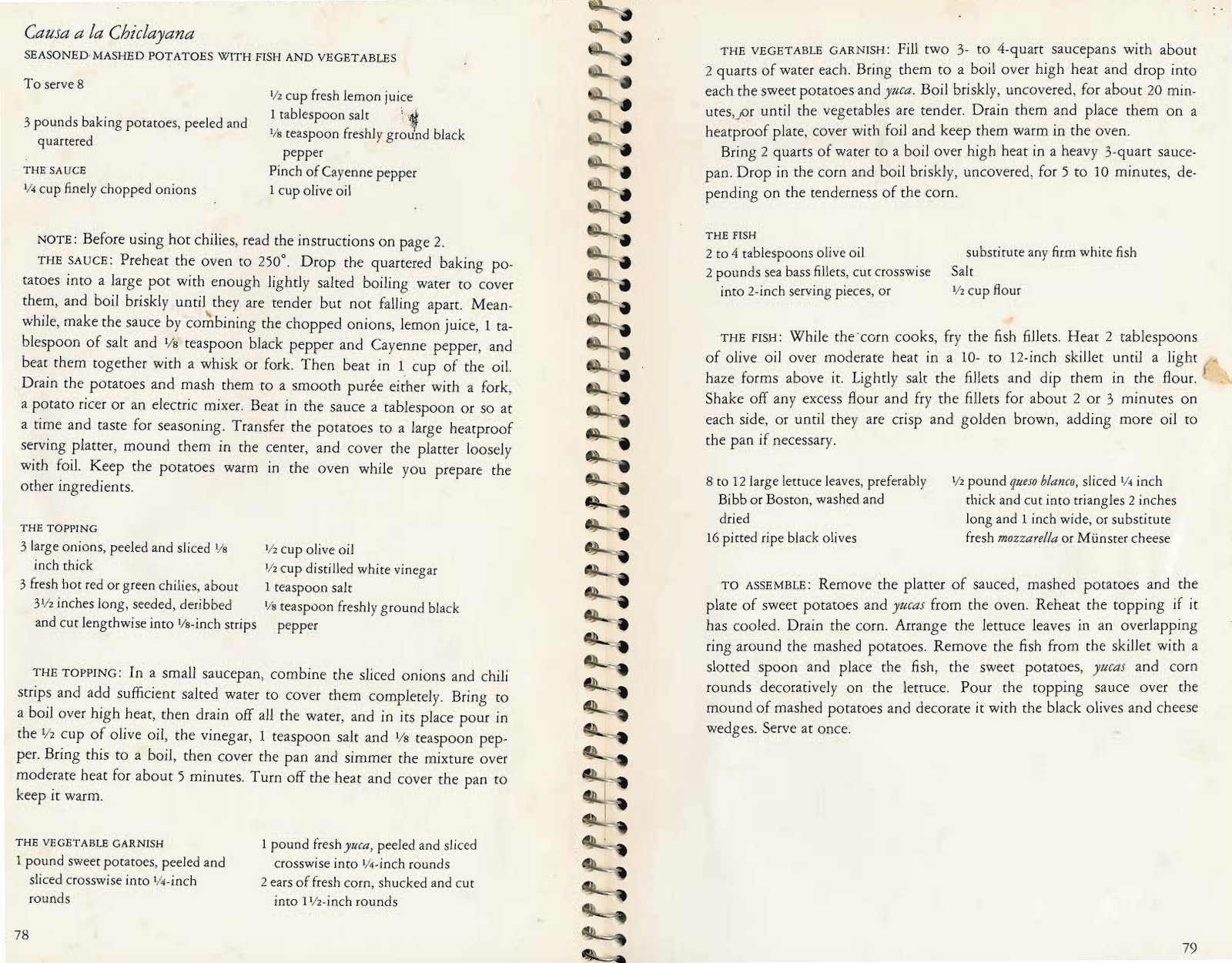

Treasury Yield Curve Methodology: The Treasury yield curve is estimated daily using a cubic spline model. Inputs to the model are primarily indicative bid-side yields for on-the-run Treasury securities. Treasury reserves the option to make changes to the yield curve as appropriate and in its sole discretion.

While the yield curve is typically upward sloping it can also be flat or even downward sloping (i.e. short maturity bond have a higher yield than longer maturities). Historically, the slope of the yield curve has been a good leading indicator of economic activity. Due to the fact that the yield curve summarizes where investors think interest.

The joint bi-factor nonlinear model of the yield curve components and the economy, and their interrelationships, is presented in Section 4. Section 5 discusses the univariate Markov switching models and the multivariate nonlinear single dynamic factor model for the yield curve components, which are used for comparison.

Other posts on the site.

Essay steve jobs horoscope analysis essay family background in sop sample football essay writing shirts my favorite gadgets essay travel english poem essay lesson plan format. Critical thinking essay questions topic ideas school uniforms essay vandalism custom essay writing reviews legal examples of scientific paper titles essay romeo and juliet mp3 wronging english essay descriptive and.

The term structure of interest rates can be described using the Yield Curve and can take one of three yield curve shapes: normal, inverted or flat. A normal yield curve indicates that the yields increase as the maturity of the bonds increases in time. As the yields increase, they create a convex shape.

In addition to the slope of the yield curve, we also are interested in changes or shifts in yield curves over time. The upward shift in the yield curve from July 2003 to July 2004 most likely reflects increased strength in the overall economy over the period rather than an increase in inflation expectations.

The yield curve is normally concave, but it is possible for it to be convex or even to be neither concave or convex. Convexity can reflect expectations of yield curve steepening. In general, the shape of the yield curve is a combination of. A. Expectations about future interest rate movements (including changes in the level and slope of the curve).

In finance, bootstrapping is a method for constructing a (zero-coupon) fixed-income yield curve from the prices of a set of coupon-bearing products, e.g. bonds and swaps. (1) A bootstrapped curve, correspondingly, is one where the prices of the instruments used as an input to the curve, will be an exact output, when these same instruments are valued using this curve.